6 Easy Facts About The Wallace Insurance Agency Explained

Wiki Article

The Greatest Guide To The Wallace Insurance Agency

Table of ContentsWhat Does The Wallace Insurance Agency Mean?How The Wallace Insurance Agency can Save You Time, Stress, and Money.The Best Strategy To Use For The Wallace Insurance AgencySome Ideas on The Wallace Insurance Agency You Need To KnowGetting The The Wallace Insurance Agency To Work

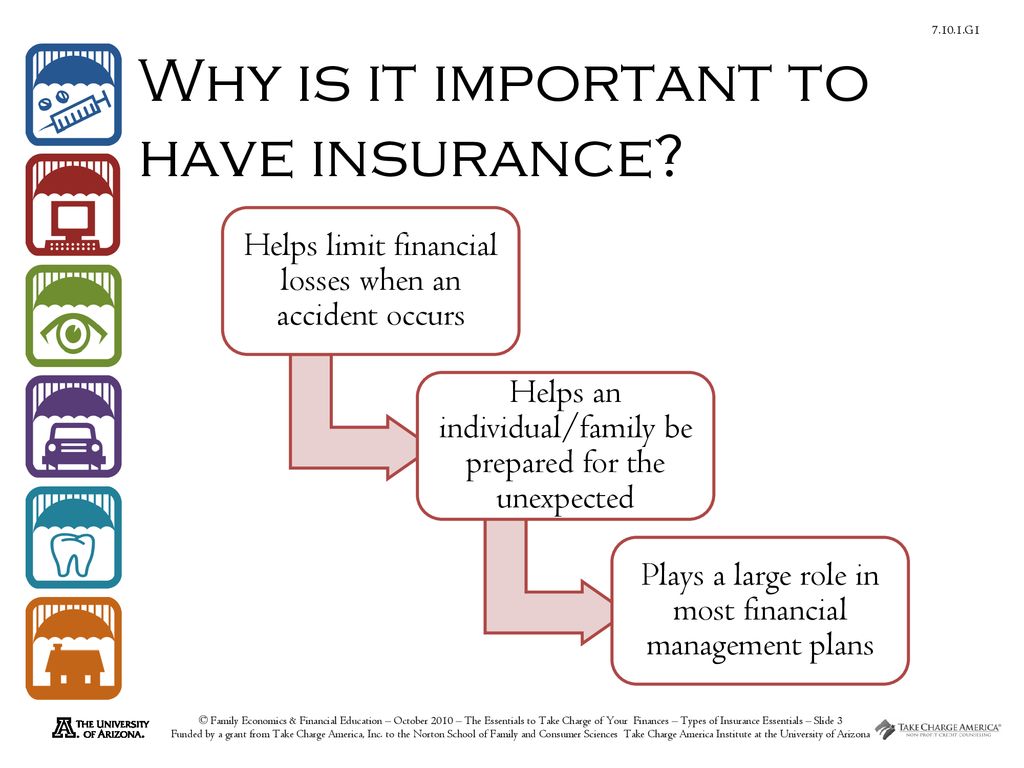

You obtain free preventative care, like injections, testings, and some check-ups, also prior to you fulfill your insurance deductible. If you have an Industry plan or other certifying health coverage through the strategy year 2018, you don't have to pay the penalty that individuals without protection should pay.There is no denying that you will have greater tranquility of mind if you know that you and your enjoyed ones are financially protected from numerous unanticipated scenarios. Uncertainties in life could turn up anytime, such as an unfortunate fatality or a medical emergency situation. These circumstances also consist of an accident or damage to your car, building, etc.

You might require to dip into your savings or your household's hard-earned money. Hence, there is a pushing need of insurance coverage for you and your household for appropriate coverage and monetary support versus all dangers linked to your life, health and residential or commercial property. Insurance strategies are helpful to anybody looking to secure their family members, assets/property and themselves from financial risk/losses: Insurance policy plans will help you pay for medical emergencies, hospitalisation, tightening of any kind of health problems and therapy, and clinical care required in the future.

The Main Principles Of The Wallace Insurance Agency

The family members can likewise settle any financial debts like home loans or other financial debts which the individual insured might have incurred in his/her life time Insurance coverage strategies will certainly help your household maintain their standard of life in case you are not about in the future (Life insurance). This will certainly assist them cover the expenses of running the family via the insurance lump amount payoutThey will certainly ensure that your kids are monetarily secured while pursuing their dreams and ambitions with no concessions, even when you are not around Numerous insurance coverage plans include financial savings and financial investment schemes along with routine coverage. These aid in structure wealth/savings for the future via regular investments. You pay premiums routinely and a section of the same goes in the direction of life protection while the other section goes in the direction of either a cost savings strategy or financial investment plan, whichever you select based upon your future goals and requires Insurance assists shield your home in the event of any unforeseen catastrophe or damage.

If you have coverage for prized possessions and products inside the home, then you can purchase substitute items with the insurance money One of one of the most important benefits of life insurance policy is that it allows you to conserve and expand your money. You can utilize this total up to meet your long-lasting goals, like purchasing a residence, starting a venture, conserving for your youngster's education and learning or wedding, and more Life insurance policy can allow you to stay financially independent even throughout your retired life.

Getting My The Wallace Insurance Agency To Work

They are low-risk strategies that assist you maintain your present way of living, meet clinical expenditures and satisfy your post-retirement objectives Life insurance policy assists you plan for the future, while assisting you conserve tax obligation * in today. The premiums paid under the policy are allowed as tax obligation * reductions of up to 1.Even more, the quantities obtained under the policy are additionally excluded * subject to problems under Area 10(10D) of the Revenue Tax Act, 1961. COMP/DOC/Jan/ 2023/41/1904 There are several kinds of insurance strategies readily available. These insurance plans come in handy in instance of clinical emergency situations; you can additionally get of cashless center across network healthcare facilities of the insurer COMP/DOC/Sep/ 2019/99/2691.

Rumored Buzz on The Wallace Insurance Agency

When you acquire insurance, you'll receive an insurance coverage policy, which is a lawful agreement between you and your insurance coverage carrier. And when you suffer a loss that's covered by your plan and submit a claim, insurance policy pays you or a marked recipient, called a recipient, based upon the regards to your plan.

Enduring a loss without insurance coverage can place you in a difficult financial circumstance. Insurance policy is a vital monetary device.

All about The Wallace Insurance Agency

For car insurance policy, look at more info it could imply you have additional cash in hand to assist spend for repair services or a substitute lorry after a crash - https://visual.ly/users/wallaceagency1/portfolio. Insurance policy can help maintain your life on course, as high as feasible, after something bad hinders it. Your independent insurance coverage representative is an excellent resource to read more concerning the advantages of insurance policy, along with the advantages in your specific insurance coverage planAnd sometimes, like automobile insurance policy and employees' settlement, you may be needed by legislation to have insurance in order to secure others. Find out about our, Insurance policy alternatives Insurance is basically an enormous stormy day fund shared by lots of people (called policyholders) and managed by an insurance coverage carrier. The insurance policy firm makes use of cash collected (called premium) from its insurance policy holders and various other financial investments to spend for its procedures and to meet its pledge to insurance policy holders when they file a case.

Report this wiki page